Core Insights

Your mindset shapes how you think, feel, and act around money—not just your balance..

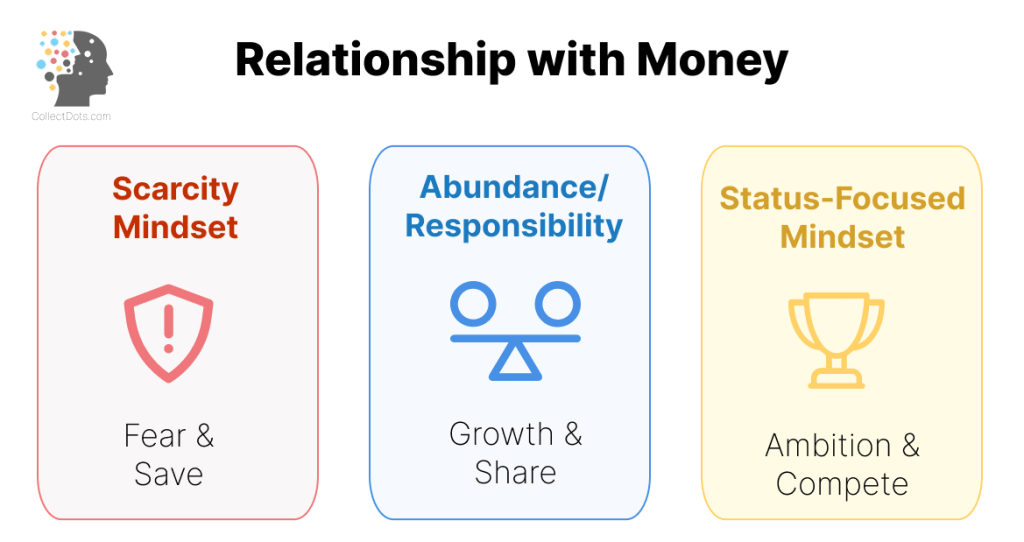

Three main mindsets affect financial behavior and success:

- Scarcity: Fear-driven, causing anxiety and risk aversion.

- Growth: Money seen as a tool, promoting confidence and long-term planning.

- Status: Self-worth tied to wealth, can lead to burnout and stress.

- Your money mindset influences spending, saving, relationships, and career choices.

- Recognizing your money mindset is the first step toward making better financial and life decisions.

- Positive change in mindset leads to financial freedom and healthier relationships.

The way you think about money shapes your daily choices, your confidence, and your relationships. Your mindset can drive caution, growth, or competition—affecting how you spend, save, and succeed.

There are three fundamental types of money relationships.

These relationships transform the way an individual thinks, behaves, and connects. They influence both finances and interactions with others.

Money is more than currency—it’s a mirror reflecting your mindset, shaping your habits, and steering the course of your life.

Driven by fear and insecurity, leading to excessive saving, risk aversion, and missed opportunities.

- Leads to anxiety and reluctance to invest or spend

- Creates barriers in relationships and growth

Impacts

- Psychological: Persistent anxiety, fear of change, preoccupation with loss

- Behavioral: Reluctance to spend, compulsive saving, aversion to taking risks or making investments

- Relationship: Difficulty sharing or supporting others financially; tension about money and control

- Financial: Missed opportunities for growth, living below one’s means, reinforcing patterns of lack

- Builds confidence, adaptability, and teamwork

- Supports financial stability and long-term wealth

Impacts

- Psychological: Hope, confidence, adaptability in the face of setbacks

- Behavioral: Healthy goal setting, smart budgeting, openness to new opportunities

- Relationship: Transparent financial communication, teamwork, and generosity

- Financial: Greater stability, long-term wealth building, and financial freedom

Ties self-worth to wealth, fueling ambition but risking burnout, debt, and constant comparison.

- Leads to striving for more, sometimes overspending or overworking

- Creates psychological stress and social tension

Impacts

- Psychological: Ambition, but also insecurity or envy

- Behavioral: Strong drive for achievement, material accumulation, and sometimes overwork or overspending

- Relationship: Prone to comparison, power struggles, or transactional exchanges

- Financial: Potential for rapid financial gain, but also risk of debt or burnout if self-worth is tied solely to wealth

Why It Matters

Your mindset shapes the way you spend, save, and invest—and how you relate to others around money. Understanding which mindset dominates helps you make conscious choices for healthier finances and relationships.

Your Money Mindset Also Influences:

- Daily decisions about budgeting and risk

- Career moves and goal setting

- Interpersonal trust and generosity

The Takeaway

Becoming aware of your dominant money mindset opens the door to change. It lets you shift towards healthier, more productive patterns that lead to financial freedom and balanced relationships.

Explore your own money beliefs—and take steps to create the relationship that supports your success.

Leave a comment